There is a PDF version of this article available for download to make it easier to share with your team.

We work with large retailers, giving us insight into their priorities. To help them prepare for the future, we focus on what’s coming next.

Our expertise is in SEO. While this PoV covers broader topics like data privacy and analytics, we focus on the SEO angle in these areas. I sat down to write this with the idea in mind that I wanted to answer the question “when it comes to organic search and SEO, what should marketing leadership be thinking hardest about right now?”.

I’ve split my thoughts into five key sections, starting, unsurprisingly, with AI:

- What does AI mean for online retail strategy?

- Google as Product Listing Page (PLP)

- SEO depreciation

- Data sources, privacy, and regulation

- How retailers are measuring success

What does AI mean for online retail strategy?

From the perspective of SEO, there are two main areas to think about when it comes to AI:

- Our use of AI tools to build, analyse, or improve our own website, competitors, or the market

- Consumers’ use of AI tools to find and choose between the products and retailers they are interested in (“AI SEO”)

There is a large and interesting topic to think about over the long run if Google struggles in the ongoing arms race between search quality and “slop” – the content that isn’t exactly spam, but is low quality ML-generated – and depending on how the technology changes, this could be a threat to training ML models generally. For the sake of this article, though, we are going to concentrate on the two sub-topics outlined above:

How should we use AI and ML tools to improve our website?

This is a fairly tactical decision for most retailers, who don’t have a major short-term threat to their business model from AI, which isn’t going to ship physical product to customers any time soon.

We have written in detail about the current state of the art and the results of our experiments improving web pages in this way. Strategically, retailers should be guided by whether users prefer pages enhanced in this way to whatever the alternative is. In our opinion, it’s OK to take this decision tactically based on alignment with brand values, user experience, and experimental results.

Our broadest lesson is that it tends to be most successful when it is used to scale and expose proprietary and differentiated data in user-friendly formats.

What should we do about “AI SEO”?

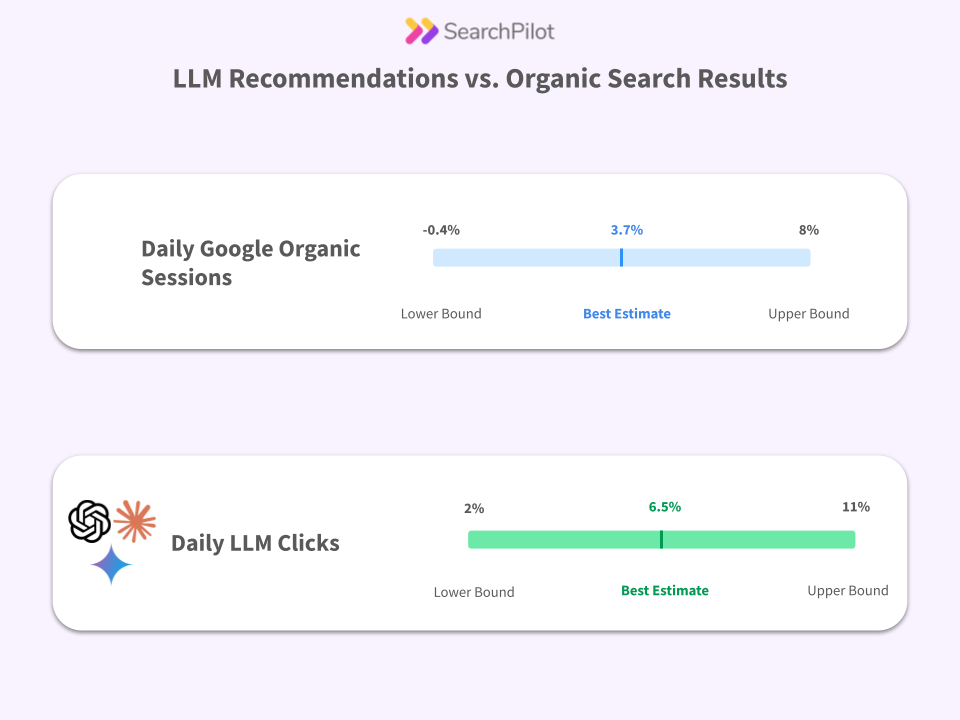

The biggest insight for marketing leadership considering what to do about consumers turning to AI tools for recommendations is to realise that regular Google search is the biggest AI-powered discovery tool in the world and it’s not even close.

Once you have accepted that “regular” search (and therefore “regular” SEO) are in fact the biggest forms of “AI SEO”, we get to the secondary insight which is that our on-site SEO strategy needs to be about appealing to Google’s AI engine.

I have written more about this in detail in my briefing for leadership on AI SEO and talked about it in depth in this presentation.

The key take-aways are:

- Our “AI SEO” strategy right now is almost entirely about what we do for Google

- Our approach for Google needs to be guided by the realisation that it’s AI-powered now

All of this leads to our belief in testing.

Google’s role as Product Listing Page (PLP)

There are two key page types that appear in most search results for commercial intent searches:

- Product Detail Pages (PDPs) - the individual products themselves

- Product Listing Pages (PLPs) - sometimes known as category pages - filterable and sortable lists of all products of a certain kind

Google has typically shown one or the other depending on the best understanding of the intent of the searcher. PDPs appeared for more specific searches and PLPs for more general searches. The current trend is for PDPs to be shown more prominently at the expense of PLPs - seemingly with Google wanting to be the PLP. You can see this trend most clearly by comparing the current UK search results to the US search results for a general product query:

The UK results are similar to the previous presentation style globally, while the US results, with their filters and sort options are more like a listing page of their own.

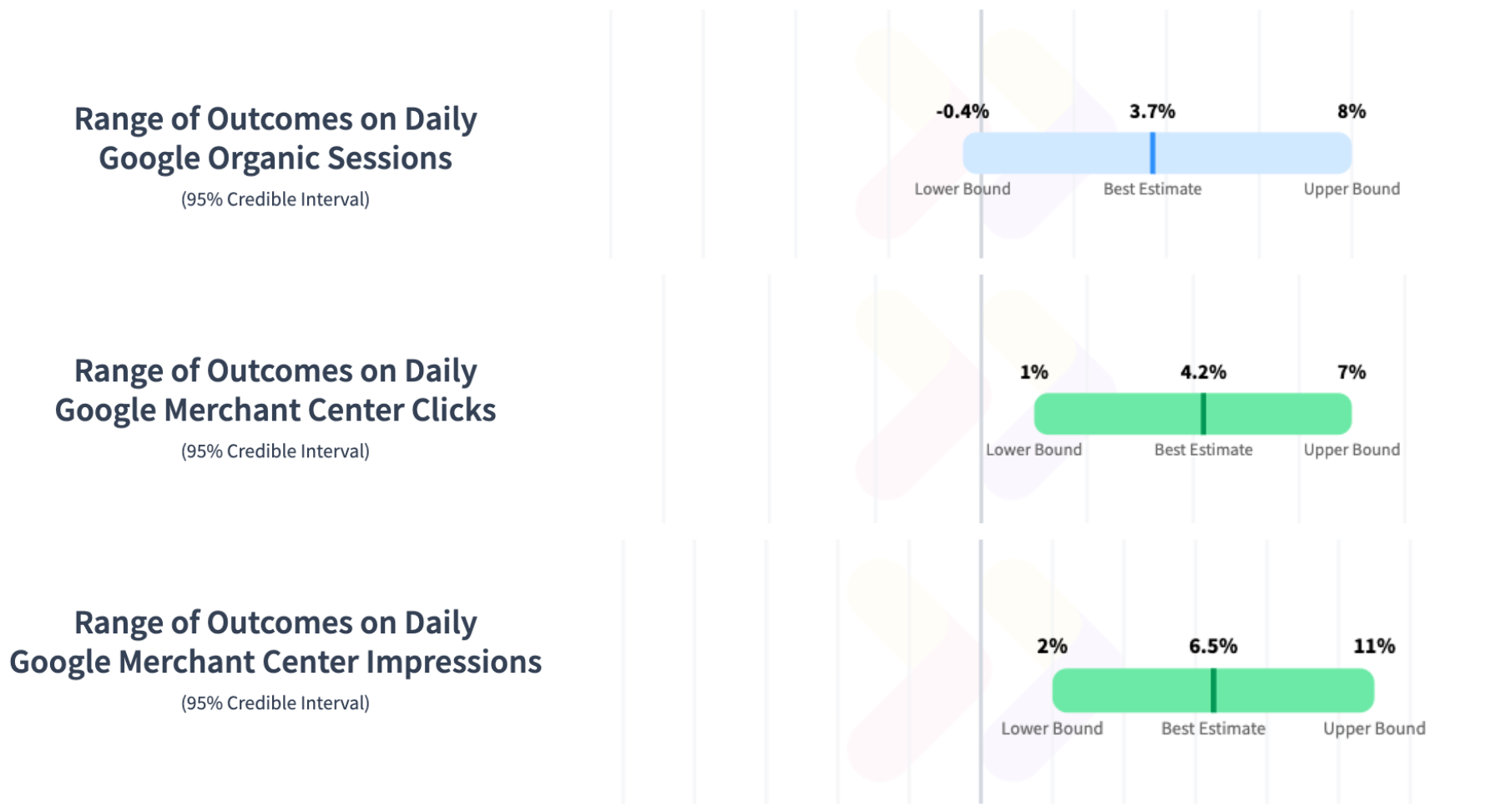

Both of these screenshots are in the regular (“all”) results tab but are trending towards looking like how the “shopping” results tab has always looked. The implication of this is that retailers should be thinking about three key and distinct sources of organic product search traffic:

- Regular “ten blue links” results containing links to PDPs (and sometimes PLPs) - often marked up with product schema information and showing as rich snippets

- Shopping tab results which are like “organic product adverts” and drive at least in part off the Merchant Center product feed, can be product variations that aren’t the canonical product (e.g. size / colour variations) or even be noindex (pages that don’t appear at all in the regular search results)

- Product search results like those seen on the shopping tab - but appearing in a grid in the regular search results - often labelled things like “popular products”

It is particularly interesting to track and report on these since:

- Search Console reports only on #1 and #3 currently - with no click or visibility data for the shopping tab (the documentation isn’t always clear on this but the shopping tab listings report links over to Merchant Center)

- Analytics data will only be able to distinguish clicks on product listings (#2 and #3) from regular web search (#1) if you link Merchant Center to your analytics (GA4 instructions here)

It is easy to undercount or misinterpret this data, but it is critically important due to the increasing trend of product search inclusion in regular results.

SEO depreciation

The changes I described in product search are just one example of a more general trend: there is more change in search results than ever before (credit to Dr. Pete at Moz for the illustration):

When I speak to marketing leaders, I often hear two conflicting things:

- If we did nothing, and made no investment in SEO, we would expect our performance to decline

- We measure the return on our SEO investment by comparing the spend to our year over year (YoY) growth

This leads to systematic underinvestment in SEO, because it misses the value of the effort expended to continue to benefit from the large amount of organic visibility big retailers already have. Organic visibility is an asset, and SEO done right is an investment that maintains and grows that asset.

Based on our research and data, a decline of up to 10-20% per year is a reasonable model for what would happen with no investment:

I have referred to this concept as SEO depreciation and it’s a key insight for planning, budgeting, and target-setting for the organic channel.

Data sources, privacy, and regulation

Web analytics has been the source of truth for most retailers for as long as I’ve been working with the web. I have talked before about why we consider traffic data to be more important than rankings alone for measuring the results of SEO experiments, and while both parts remain true, the situation is growing increasingly complicated.

Privacy regulations are the main reason for this shift. In many regions, the cookies that analytics tools rely on to track sessions require users’ explicit consent. Even in jurisdictions where this is not the case, many large organisations are choosing to treat them this way - either to be completely sure of complying in the jurisdictions where it is required, or in anticipation of stricter regulations in other markets.

While it is possible to implement privacy-preserving “hits based” analytics that doesn’t tie sessions together, many analytics tools simply don’t count any visits where the cookie is rejected (confusingly, GA4 looks like it’s tracking them, but they aren’t actually tracked in the data).

Unlike product search trends led by the US, privacy regulations in the UK and Europe are making a bigger difference to how retailers track and measure data - sometimes with unintended consequences.

The upshot of all of this is that many retailers are finding that their analytics data is much more of a sample than it used to be, and since it’s a non-random sample, it can be more limited in its value for measurement and testing than it used to be.

We’re seeing a rise in the use of measurement tools that either don’t require cookies at all or piggy-back on the cookie permissions of the internet giants - most notably Search Console in the case of Google. This is why we have built Search Console integration into SearchPilot.

As I mentioned above in the discussion of measuring product search, Search Console has its own limitations (in addition to those mentioned above, sampling, and a lack of conversion data!), and so we are seeing a trend towards measurement that relies on a range of tools focused on different jobs rather than a single source of truth.

How retailers are measuring success

Speaking of measurement, the other big trend we are seeing is in how large retailers are thinking about what success looks like. We are seeing it be increasingly common that they are focused on:

- Performance relative to competitors

- Segmented performance by business unit or product type

The kind of experimentation we do can improve both of these, and we are more and more thinking about the business unit segmentation during test design. In particular, we think about hypotheses that apply to specific groups or product areas, we design smart bucketing that takes account of the segmented analysis we want to run, and we report on the impacts by business unit.

Relative performance is a particularly interesting one. A large part of the reason we run controlled experiments is to isolate the impact of specific changes to improve performance. Measuring performance relative to competitors over longer time periods is the equivalent of this approach when applied to company performance as a whole. When the whole market shifts (e.g. when Google makes changes like the product search changes discussed above), it may be impossible to be unaffected, and the interesting question is often whether you did better than others who started in a similar position to you.

Getting more insights from SearchPilot

If you found this round-up useful, you might consider registering for our Flight Log email newsletter:

Insights, data, and articles about ecommerce and retail SEO from the SearchPilot team: